The Four Horsemen of AI-Powered Fraud

AI is transforming the digital landscape — and fraudsters are riding the wave faster than the businesses and consumers they target. With chilling precision, they’re weaponizing AI to launch attacks that are faster, smarter and harder to detect.

These modern-day marauders aren’t cloaked in mystery; they’re armed with accomplices, bots and stolen data, casting a curse on digital businesses. This Halloween, we’re shining a light on the Four Horsemen of AI-Powered Fraud — and the terrifying ways they’re reshaping the threat landscape.

1. Fearsome Fraud Rings

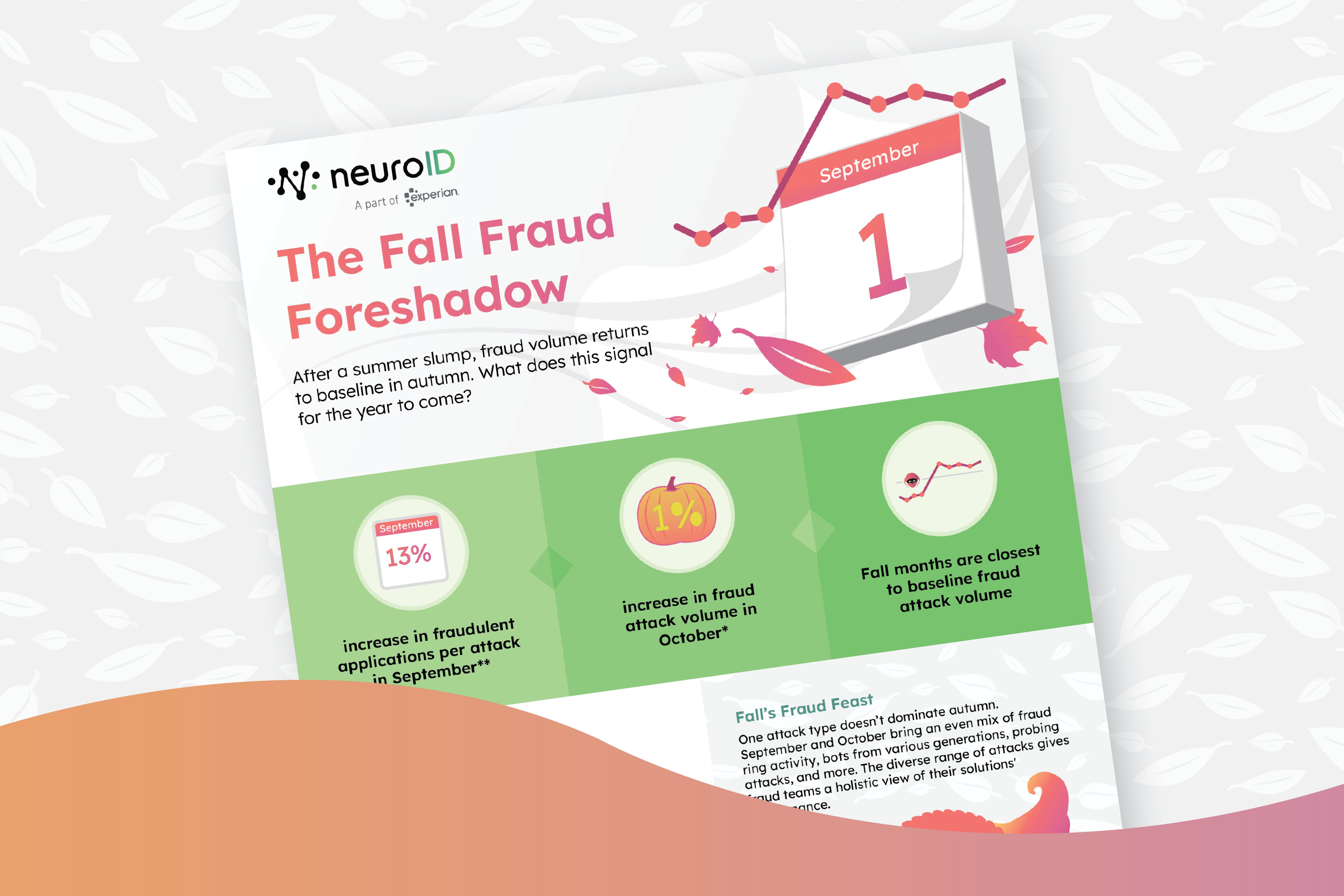

As online fraud grows more lucrative, fraud rings frighteningly operate like business enterprises. Members have defined roles and work together under an organized structure to carry out coordinated attacks. They’re using AI in the same way as many businesses around the world; it’s helping them work faster, more efficiently and increase their output.

Before GenAI was widely adopted, a coordinated attack typically took weeks or months to materialize. Fraud rings had to carefully and manually scout potential targets, compile enough stolen or synthetic ID data (or compromised credentials for existing accounts) to use and recruit enough members to carry out their plan.

AI has streamlined the entire process. With increased data availability and sophisticated, adaptable bots automating attacks (more on both of these in a moment), fraudsters can execute massive attacks with a fraction of the resources they used to. They’re being less selective as a result: seasonal fluctuations have given way to year-round onslaughts, and industries that used to be an afterthought for certain attack types are now targets.

2. Supercharged Scams

For a long time, education around scam prevention was relatively straightforward. Businesses instructed consumers to look for easy-to-spot spelling and grammar mistakes, awkward formatting, strange email addresses and similar giveaways to determine if a message was real or not.

Now, AI is defying what many consumers expect of scam schemes. GenAI helps fraudsters craft more natural, convincing messages to fool consumers. Traditional red flags aren’t as prevalent, and fraudsters are able to create and send messages to their targets at an alarming scale.

More-targeted schemes use AI-generated audio or video to convince recipients that messages are coming from someone they know, taking advantage of individual consumers and enterprises alike. As a result, scams are more effective than ever, and businesses are rushing to find the right balance of consumer education and back-end fraud prevention technology to protect themselves.

3. Big Bad Bots

AI has supercharged fraud bots, transforming rudimentary scripts into advanced, adaptive entities capable of carrying out large-scale attacks.

Today’s bots leverage AI to appear more human-like and bypass traditional bot detection solutions. Many detection strategies are device-based, so modern bots cycle through device and network data to avoid detection. They use “behavior hijacking” to replicate real humans’ behavior. To businesses who haven’t modernized their bot detection solutions, modern, AI-powered bots are often indistinguishable from genuine customers.

These sophisticated bot scripts are easier to create, adapt and deploy than ever before. GenAI tools like FraudGPT make tailored bot scripts accessible to anyone who’s willing to pay the $200/month price tag. These fraudsters don’t need a high degree of technical knowledge or ability; they can simply take the output of these fraud-focused AI tools and fly under the radar of unprepared businesses.

As a result, bots are driving the future of fraud. By the end of last year, bots made up 80% of all attack attempts NeuroID observed, up from 30% at the start of the year.

4. Droves of Dark Web Data

Those sophisticated bots don’t just supercharge the execution of attacks. They’re also being used before the attack, harvesting massive volumes of personal information from public websites, breached databases and unsecured platforms. This data — ranging from PII and login credentials to behavioral patterns — is scraped faster and more efficiently than ever before, then packaged and sold on dark web marketplaces.

Once in circulation, this data fuels a wide range of attacks. Fraud rings and solo actors use it to create synthetic identities, take over existing accounts and craft highly targeted phishing campaigns.

In 2024, 1.7 billion consumers’ data was compromised in breaches. Much of that sensitive data is floating around the dark web, available to any fraudster who deems it useful. With AI making tools to capitalize on stolen data more effective and accessible — synthetic identity tools, MFA bypass tactics and, of course, bots — fraudsters are incentivized to scrape, sell and use stolen data at scale.

Stopping the Stampede

The Four Horsemen of AI-Powered Fraud aren’t just a seasonal scare — they’re a persistent, evolving threat that’s redefining fraud prevention. As fraudsters continue to harness AI to scale their attacks, businesses must respond with equal innovation and urgency.

The good news? NeuroID unmasks the disguised, AI-powered threats fraudsters deploy, offering a powerful layer of defense that goes beyond traditional detection. By understanding the tactics of these AI-enhanced adversaries, organizations can build smarter, more resilient fraud prevention strategies — and keep the monsters at bay, long after Halloween ends.

For more, and to see what these threats look like in action, check out our recent blog post: “The Haunting of a Top 5 Bank”.