It’s been one year since NeuroID joined Experian! Discover how we’re shaping the future of fraud prevention together — and what lies ahead for our solutions.

NEXT-GEN FRAUD PROTECTION

Upgrade to Frictionless, End-to-End Fraud Protection

Detect fraud rings, malicious bots, and other bad actors, anywhere across your user journey, starting on day 1.

Trusted By

Protect Your Entire User Lifecycle Without Sacrificing UX

A single integration stops every type of third-party fraud from stolen IDs to ATO from the very first interaction—with no additional user friction.

Are Next-Gen Bots Outsmarting Your Fraud Stack?

Early bot detection methods like IP blocklisting, user-agent analysis, and basic behavioral heuristics were effective against early generation fraud bots with predictable, inhuman patterns. But as detection methods advanced, so did bots, using generative learning to specifically evade these tools.

2X

Increased bot volume

In June 2024, bots led 2x the number of attacks than they did in January 2024. Speed, scale, and sophistication—these next-gen bots are a triple threat. How can you fight back?

95%

More Next-Gen Bots

of the bots were next-generation, for almost 50% of our customers.

100%

Risky Sessions

of financial services businesses are targets. Every NeuroID customer with bot activity over one 7-week study had some form of fourth-generation bots.

Uncover an account takeover invasion in action

Fraud rings aren’t random — they’re organized. Like the businesses they target, these rings operate with precision: scouts find weak spots, testers validate stolen data, and specialists cash in. Their playbook? Step-by-step guides and even stolen credentials to scale attacks fast.

The result: Account takeover losses hit $16B last year, with attacks surging 24% year-over-year.

Want to stop them?

Stop All Third-Party Fraud . . .

- Bots

- Mules

- Promo Abuse

- Payments

- Account Take Over

- Profile Changes

- Scams

- Gen AI

. . . At Any Point of Entry

Signup/Onboarding

User Login

Profile Changes

Checkout/Transaction

Modern Platforms Mitigate Fraud With NeuroID

Industry leaders use NeuroID to protect their platforms, minimize user friction, and reduce their costs.

Gain Visibility Into the Fraud Activity You Know Exists But Can’t Yet Detect

Deep dive into the benefits of advanced fraud intelligence with resources from our experts.

BLOG

The Buyer’s Guide to Behavioral Analytics for Fraud Prevention

Fraud and identity professionals are increasingly turning to behavioral analytics to defend against modern fraud attacks. Many are eager to learn about and test new providers, but choosing and implementing the right solution isn’t always easy. This guide answers the questions fraud teams face when evaluating behavioral analytics solutions and provides best practices for ensuring an effective integration.

report

The Fraud Fighters Bootcamp

Welcome to the Fraud Fighters Boot Camp: a three-part video series for fraud leaders looking to stay ahead of advanced attacks. Join thought leaders from NeuroID, Experian, and Terrace Finance as they discuss strategies to detect, disrupt, and defend against modern digital threats.

on-demand webinar

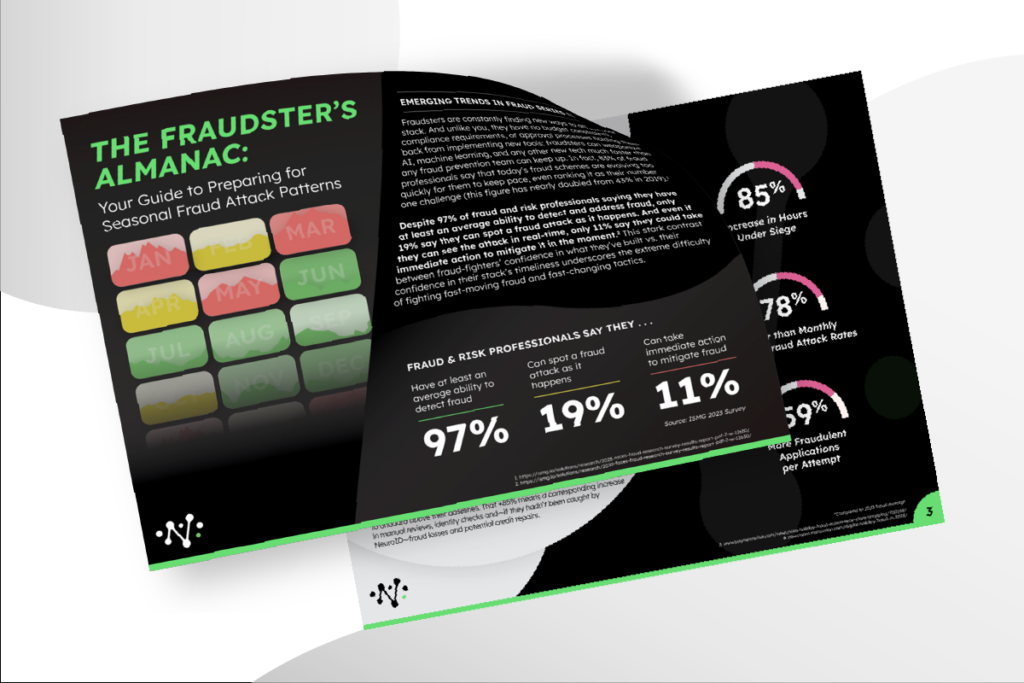

Emerging Trends in Fraud: The Fraudster’s Almanac

Explore in-depth breakdowns of seasonal patterns, even to the hour-by-hour length and velocity changes of different attacks (and what these patterns tell our data scientists) and strategies your peers took to proactively fight unseen fraud gaps, with stories from the front-lines of fraud mitigation.

Don’t Fall Behind Fraudsters.

Integrate cutting-edge, frictionless behavioral fraud intelligence that protects your entire user lifecycle, from a partner who understands your needs.