State of Fraud 2025: What the World Foreshadows

Over the past few weeks, my colleagues have unpacked the biggest fraud challenges facing U.S. businesses — from rising losses and eroding trust to the friction dilemma that continues to frustrate consumers and fraud teams alike. But fraud leaders know the U.S. isn’t always first to face these challenges; in many cases, we’re reacting to trends that have already taken root elsewhere around the world.

It’s a thorn in the side of those of us who are always pushing for innovation, but it presents an opportunity for businesses who are willing to look ahead. U.S. businesses can learn from global markets — especially fast-moving regions like the UK, Brazil, and APAC — and prepare for what’s coming next. Many of the trends dominating these markets will eventually make their way to the U.S., and organizations who are ready for them will have a major advantage over those who wait.

Let’s look at three global fraud trends that haven’t fully arrived in the U.S. yet, and the opportunities they present for forward-thinking businesses.

Trend #1: Fraud + AML Convergence

In EMEA and APAC, 65% of businesses are already integrating fraud and anti-money laundering (AML) efforts. The UK isn’t far behind at 60%. This convergence is helping businesses build a more accurate picture of risk exposure: detecting fraud disguised as defaults or chargebacks, and responding to the growing overlap between financial crime and credit risk.

The Opportunity for U.S. Businesses:

Most U.S. organizations still treat fraud and AML as separate disciplines. But as fraudsters become more sophisticated and financial crime networks more interconnected, siloed approaches won’t cut it. U.S. businesses can get ahead by investing in approaches that combine fraud, credit, and AML data — giving teams a holistic view of threats and enabling faster, more accurate decisions.

Trend #2: Fraud Orchestration as a Strategic Priority

In Brazil, 75% of companies say it’s essential to have more than one layer of protection against fraud. And in EMEA/APAC, 73% of leaders say orchestration is key to reducing onboarding friction. Just like the U.S., fraud threats are rapidly evolving in these markets; businesses in these areas are responding with smart orchestration tools that dynamically respond to risk signals.

The Opportunity for U.S. Businesses:

Many U.S. fraud stacks are still static, relying on rigid flows and one-size-fits-all checks. That’s a problem. Dynamic fraud orchestration allows businesses to adapt to threats in real time, applying the right amount of friction at the right time based on user behavior and risk signals. It’s a win-win: fraud teams get stronger defenses, and customers get smoother experiences. U.S. businesses that evolve their orchestration approach now will be better positioned to scale securely in the future.

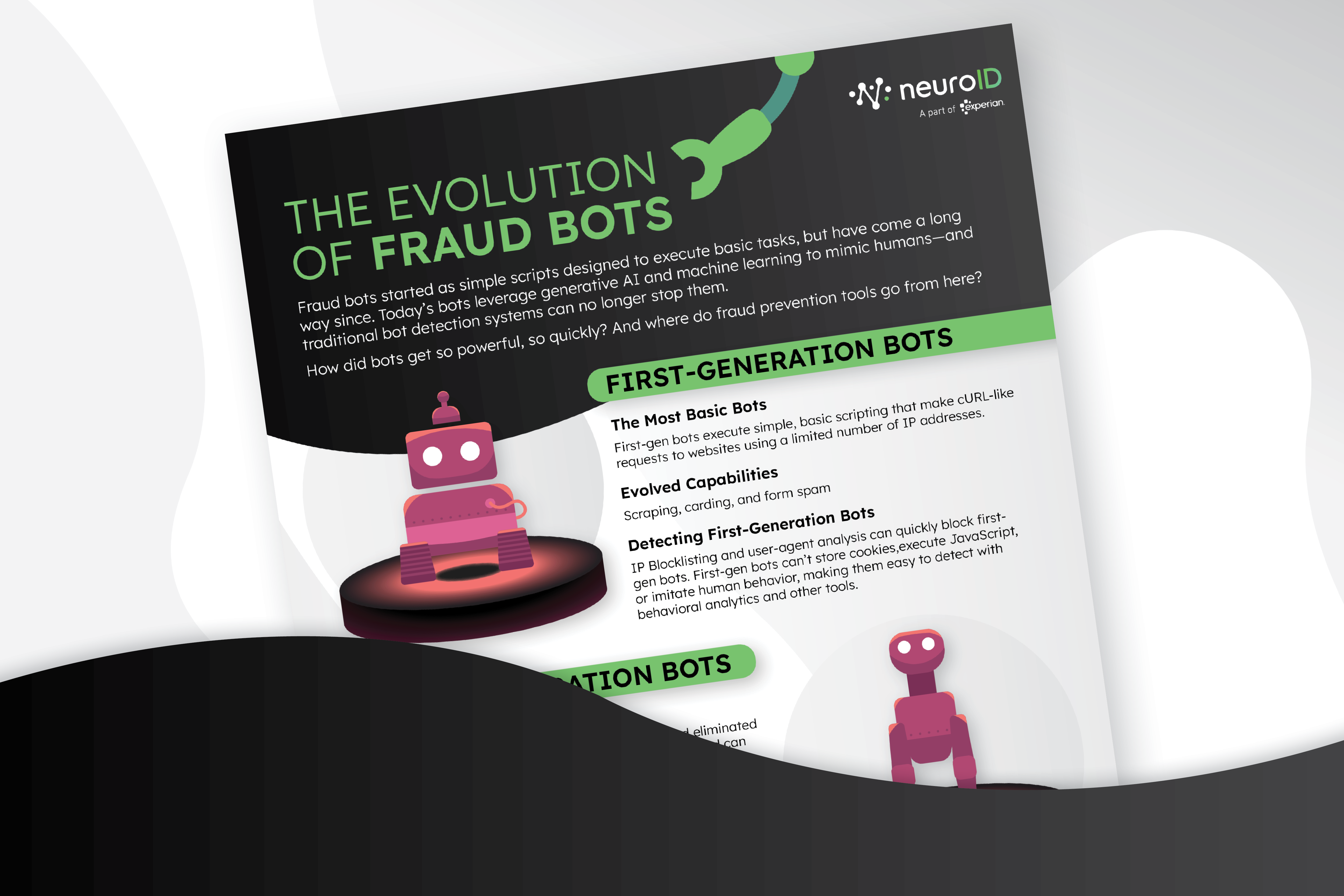

Trend #3: Evolution of GenAI-Powered Fraud

Globally, fraudsters are doubling down on GenAI to supercharge their attacks. A new generation of bots — designed to mimic human behavior and circumvent device-based controls — are bypassing traditional detection methods with ease. These bots are harder to spot and quick to adapt, meaning attacks (and the resulting damages) can scale quickly.

In the U.S., businesses are deeply concerned about GenAI fraud — 70% expect it to be one of their biggest challenges in the next 2–3 years. But only 8% are prioritizing investment in GenAI fraud prevention. It ranks second-lowest in confidence among fraud types, despite being one of the most stressful threats.

The Opportunity for U.S. Businesses:

AI-powered bots are already threatening U.S. businesses and placing strain on their fraud tools. The hesitancy to invest in combatting them stems from a refusal to compromise growth; most U.S. businesses are still prioritizing revenue over fraud prevention, even as losses rise.

This is where behavioral analytics becomes essential. With behavior, businesses can effectively stop sophisticated bots and other advanced threats without adding friction for users. It can power the dynamic workflows I mentioned above and stop attacks in real time, all while enabling seamless experiences that draw in new customers.

Bonus: The Rise of APP Fraud in the U.S.

For regions with more-developed real-time money movement (RTMM) infrastructure, APP fraud has grown into a top concern for fraud teams. As RTMM rises in the U.S., we’ve anticipated a similar shift — and saw it come to fruition in 2025.

In the first half of the year, APP fraud was one of the three most experienced fraud types for U.S. businesses. As expected, we’re seeing businesses and industries who embraced RTMM early, like P2P payments companies, gain trust and grow faster than those who didn’t.

Looking Ahead

From orchestration to GenAI threats to integrated risk management, international markets are setting the pace for the fast-moving fraud landscape. It’s giving U.S. businesses a chance to learn, adapt, and lead. The key is to act now — businesses who anticipate and embrace forthcoming trends will be well-positioned to capitalize on them if and when they arrive in the U.S.

That wraps up our 2025 State of Fraud series. Want to stay ahead of what’s next? Subscribe to our blog and check out Experian’s Global Fraud Snapshot for more insights on the worldwide fraud landscape.