The Problem

When managing fraud, it’s natural to focus on catching the ‘bad guys.’ Decisioning engines crunch through historic data, coupled with overtooled verification processes to weed out the bad and minimize fraud loss. Unfortunately this is often at the expense of perfectly good customers. For this credit card issuer, a large percentage of low-fraud-risk applicants were being subjected to unnecessary verification – which Neuro-ID ultimately revealed as a 43% false positive rate.

The Solution

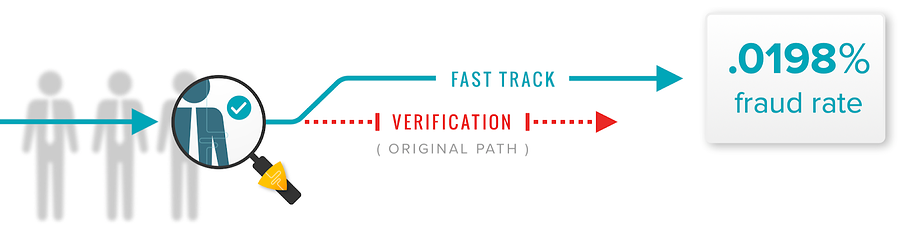

NeuroID worked with the issuer to integrate its lightweight technology and begin collecting and translating high-fidelity, field-level behavioral metrics in reNeuro-ID worked with the issuer to integrate its lightweight technology and begin collecting and translating high-fidelity, field-level behavioral metrics in real time. By translating in-session behavior, Neuro-ID detected applicants with lowest fraud potential to fast track around unnecessary friction-heavy verification

Neuro-ID opened our eyes to a large opportunity to increase revenue, taking on low fraud risk.

Fraud Strategy Director

The Impact

Neuro-ID’s solution gave their client the confidence to pave a lower-friction path for their best applicants.

- Isolated 43% of population to fast track, with a fraud rate of only .0189%

- Reduced false positives, increasing conversion

- Estimated annual ROI of $1M in additional revenue

Ready to prescreen digital identity at scale?

Get a personal demo. See crowd-level behavior at scale, and protect yourself from fraud rings. Get started fast, with you first 30 days of ID Crowd Alert on us.