The Problem

It’s difficult to see a quality customer walk out the door, but that’s exactly what was happening for this online lender during a final bank verification step in their application. The sensitive, high friction point was causing 60 to 70% of their best customers to abandon the loan process.

The Solution

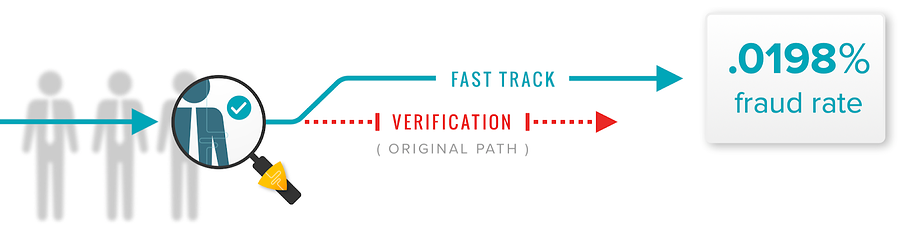

Neuro-ID worked with the organization to integrate its behavioral analytics behind their forms, to collect and translate high-fidelity, field-level behavioral metrics in real time. Neuro-ID’s technology enabled them to identify their best applicants, prior to any invasive verification measures, to apply a lighter touch, bypassing the point of friction, and fast track for conversion.

This unlocked the ability to personalize verification paths with a sharp lens into anomalous behavior and applicant intent, which helped them fight fraud while focusing on conversion and growth.

Neuro-ID’s real-time solution reduces unnecessary friction for our customers and helps me manage the activity of my loan advocates.

Top Online Lender

Chief Risk Officer

The Impact

Neuro-ID’s solution gave their client the confidence to pave a lower friction path for their best applicants:

- Conversion rate nearly doubled, while remaining risk neutral

- Realized ROI of 700+%

- Dramatically improved customer experience

Ready to prescreen digital identity at scale?

Get a personal demo. See crowd-level behavior at scale, and protect yourself from fraud rings. Get started fast, with you first 30 days of ID Crowd Alert on us.