Customer Story

Customer Story

How NeuroID Saves Elevate $1-2M a Year Through Accurate Fraud Detection and Operational Efficiency Improvements

Read MorePayment Processor Streamlines Customer Onboarding with 97% Decisioning Accuracy from NeuroID

Read MoreFrom Overwhelmed to Overhauled: Jovia’s Strategic Approach to Stopping Fraud Surges

Read MoreFrom Strenuous Checks to Streamlined Processes: How NeuroID is Supercharging Addi’s Growth

Read MorePayment Processor Pinpoints Thousands of Fraudsters & Saves Millions with NeuroID

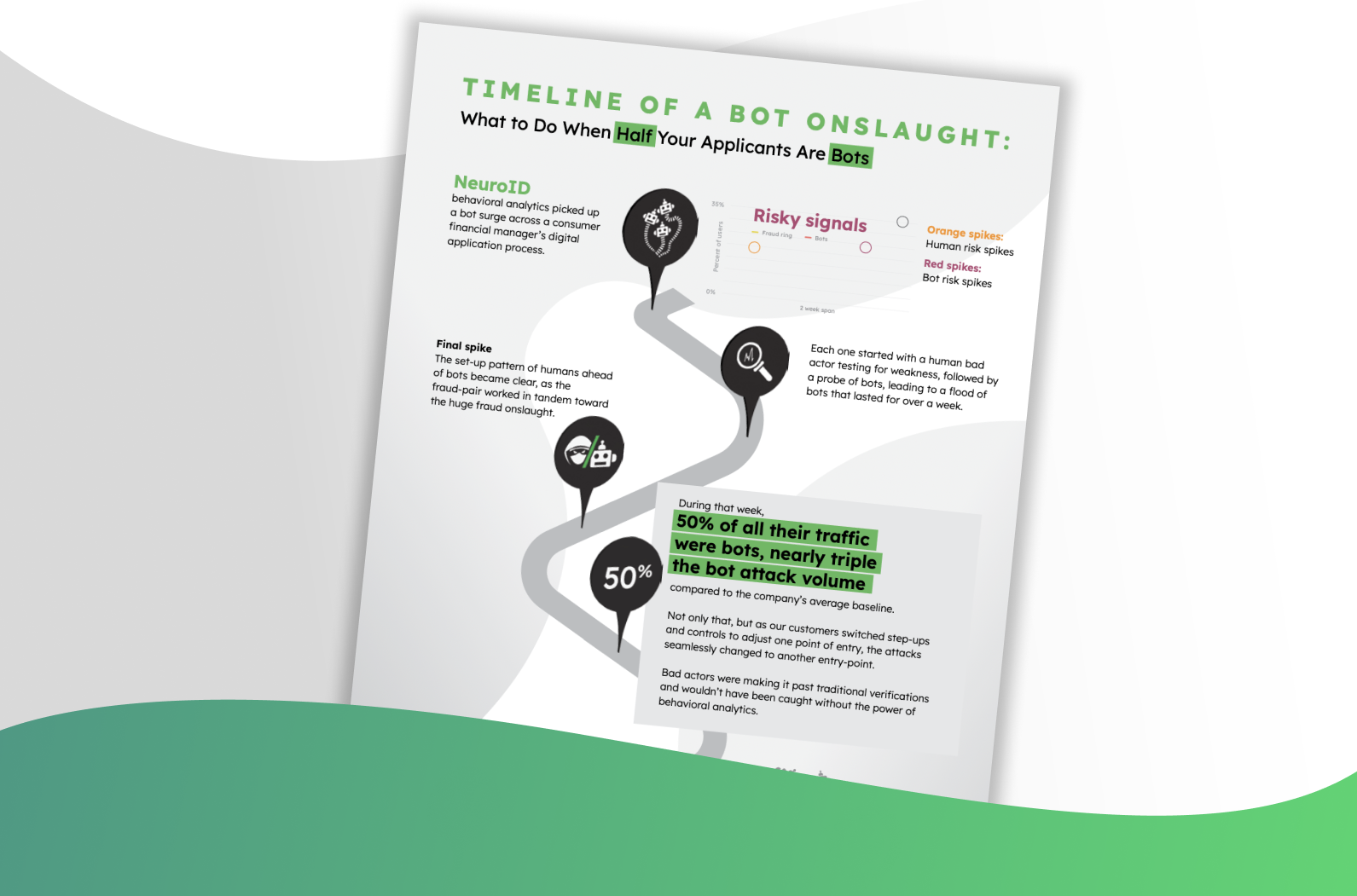

Read MoreTimeline of a Bot Attack

Read MoreBehavior Secures Growth for Top Insurers

Read MoreCatching Fraudulent Behavior for Top Merchant Services

Read MoreBehavior Secures Growth for Top Banks

Read MoreGet our latest insights in your inbox